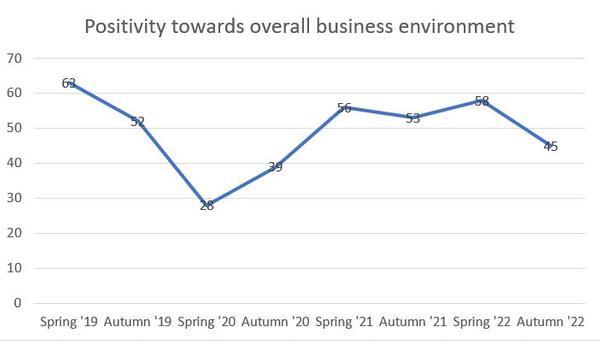

Autumn 2022 Pulse Survey results

ITI’s latest Pulse survey reveals that business confidence has dipped sharply.

Carried out in the first three weeks of October and during a period of economic and political instability in the UK, it is perhaps unsurprising that the latest issue of ITI’s twice-yearly survey of members shows a 13-point dip in member confidence. Only 45% of respondents said they were feeling either ‘very positive’ or ‘positive’ about their work and prospects in the current business environment, compared to 58% in the Spring. Interpreters reported feeling more positive than translators (57% vs 44%).

Despite this sharp decline, confidence remains significantly higher than the depths to which it fell in 2020 during the Covid pandemic.

64% of respondents said they had gained new clients or business in the last 12 months (versus 66% in the Spring survey). But in respect of existing clients, only 38% said they had seen an increase in the amount of work received and 46% reported a decrease (46% and 36% previously).

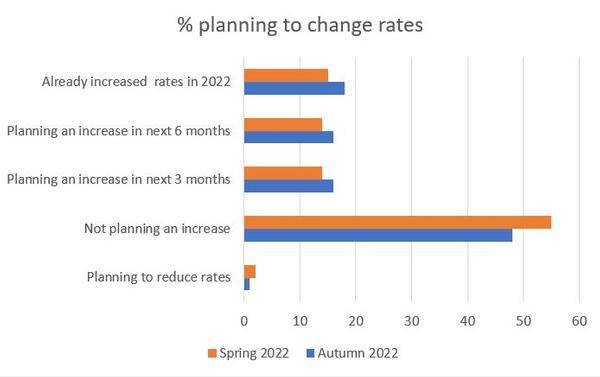

Reflecting external pressure, 50% of respondents have now either implemented a rate increase in 2022 or are planning to do so in the next 3-6 months. 25% of respondents reported either a slight or significant improvement in their earnings overall in the past 12 months (vs 20% a year ago), demonstrating the positive effect a rate rise can have.

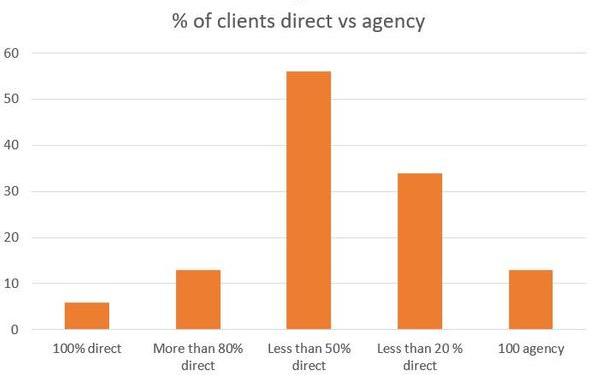

In this edition of the Pulse survey, we asked members about their split between agency and direct clients for the first time. The findings show that 13% of respondents rely entirely on agencies for their work while 8% work exclusively for direct clients. The average split was 63% agency / 37% direct, with interpreters relying less heavily on agency clients than translators (53% for interpreters vs 65% for translators).

We also asked how members find their direct clients. The most frequently stated sources were recommendations (49%), the ITI Directory (41% (MITIs and FITIs only)), referrals (26%), LinkedIn (20%) and networking (18%).

Looking forward to 2023 and CPD, respondents are planning to focus on their subject knowledge (56%), language skills (41%) and technology skills (38%). When asked about the introduction of new CPD badges, 36% said it had/will encourage them to continue logging their CPD beyond the initial 30 hours achieved. When those who don’t log their CPD are excluded, the figure is 42%.